NPA Management tool is the banking solution that helps lending establishments to manage the large documentation and compliance part that comes with managing the NPAs and put an end to the manipulations of NPAs.

NPA Management in Banks

Unmitigated NPAs is proving to be a major challenge for banks all over the world. Degrading the banks’ credit rating and credibility is only one of the few issues increasing NPA levels have caused. Keeping it in check and recovery of delinquent loans is now one of the most priority tasks for sustaining profitability.

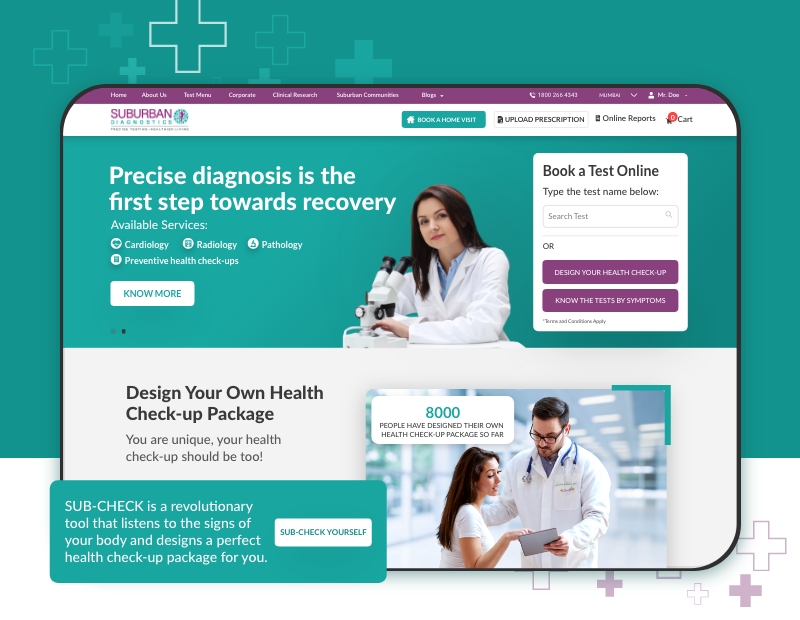

Intelegain offers one of kind NPA Management tool that helps banks, NBFCs, and other lending institutions initiate the recovery process and delink NPAs from the bank.

NPA Management Solution in operation

Intelegain’s NPA Management Solution is a result-oriented solution that is developed with the objective of bringing a revolutionary change in the field of NPA recovery. It is a perfect tool to manage NPA and can be integrated with the core banking solution- to monitor, track customer data – helping banks take proactive actions to mitigate recovery risks.

- Offers support for consistent follow-ups and escalations in NPA

- Empowers banks, NBFCs and other lending institutions in effective monitoring and NPA recovery

- Assists in initiating recovery process with workflow, for e.g. SARFAESI, Sec 138 Criminal Suit, DRT process etc.

NPA recovery Tool benefits

- Detecting probable loan defaults in advance- enhancing loan recovery process and empowering banks to monitor its performance from the very start.

- Extensive data published in easily comprehensible format.

- Proactive criterial based follow-ups, contact processes and configurable workflows for systematic asset recovery.

- Increases profitability by curtailing NPA in banks and maximizing the lending capacity of the bank.

NPA Management Features

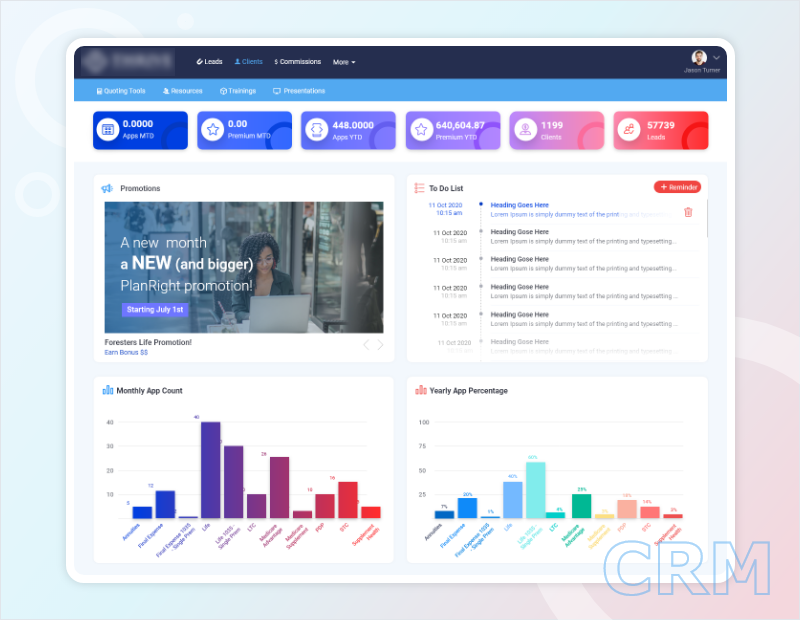

- Access Control, Dashboards based on roles

- Borrower Profiling – consists of debt profiles, loan documentation, security documents, charge status and valuation details etc.

- Case management, Notices / Legal Status Management, Calendar and Reminders

- Bulk data upload, Reporting Module

- Associate Details and Performance Management

- Expenses Management

- Knowledge Management, Outlook Plug-in, Analytics, Litigation Management