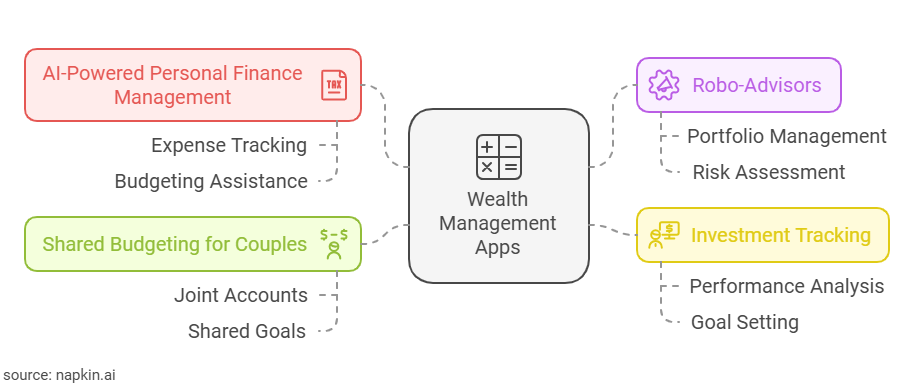

As technology continues to evolve rapidly, the best wealth management apps have become indispensable for those looking to take control of their finances and achieve financial success. In this blog post, we’re diving into the best wealth management apps of 2025, highlighting innovative features like AI-powered personal finance management, sophisticated robo-advisors, advanced investment tracking, shared budgeting app for couples and more to help you navigate your financial journey. Also highlighting their key features and offering helpful tips to help you choose the app that best fits your needs.

Whether you’re seeking a complete financial overview or automated investment solutions, these top wealth management apps provide a range of tools and resources designed to enhance your net worth and help you meet your financial objectives.

Top Wealth Management Apps

1. Empower

Empower is an excellent example of how a mobile app development company can create intuitive, user-friendly platforms that streamline wealth management for individuals seeking to build wealth and plan for retirement. By connecting your bank accounts, credit cards, student loans, mortgages, and other financial items, Empower creates a detailed financial snapshot, enabling you to take control of your finances.

Key features include:

-

- Visualized financial summary

- Simple account tracking via account linking

- Tools for wealth building and retirement planning

- Fee analysis to help save money

With its user-friendly design and effortless account linking, Empower stands out as a top choice for tracking investments compared to other free budgeting apps.

Renowned for its effectiveness in financial management and wealth building, Empower provides budgeting tools, investment tracking, and personalized advice. A key benefit is that it’s considered the best free budgeting app, with no monthly fees attached to its services.

Empowers financial advisors offer customized guidance to help you stay aligned with your financial objectives. Its extensive range of free budgeting tools makes Empower an excellent option for those seeking to enhance their financial management approach.

2. Betterment

Betterment is an automated investing platform, also known as a robo-advisor.

Key features include:

-

- Users can build and manage their investment portfolios online.

- Personalized portfolios are tailored to individual financial goals.

- Additional financial planning tools are provided to help users meet their objectives.

As a robo-advisor, Betterment offers:

-

- Automated portfolio management.

- Risk evaluation.

- Financial planning services.

- Personalized advice and recommendations.

Betterment is a great option for those who prefer an automated approach to investing and wealth management. With its user-friendly interface and goal-oriented investing features, Betterment simplifies the investment process while helping you stay on track with your financial goals. If you’re seeking a wealth management app focused on automated investing, Betterment might be the right choice.

3. Mint

Mint is a popular budgeting app that also helps users track their wealth by monitoring net worth and financial progress.

Key features include:

-

- Tracking financial goals

- Generating reports on spending habits

- Syncing bank accounts

- Monitoring expenses

- Categorizing spending

- Automating savings

- Providing savings tips

- Sending bill alerts

- Accessing credit scores

- Investment tracking

A key benefit of using Mint is its accessibility, as it provides a free version with a wide range of features for budgeting and wealth management. Its unique offerings, such as access to credit scores and investment insights, set it apart from other budgeting apps. Mint is the best example of how expense management app development should be done.

By helping users understand their spending habits and create personalized budgets, it plays a significant role in enhancing financial management and achieving financial goals. If you’re looking for a complete budgeting app that also includes wealth tracking features, Mint is one of the best options.

4. Honeydue

Honeydue is a user-friendly wealth management app designed for couples, combining financial organization and collaboration in a seamless way. With its intuitive features, Honeydue allows partners to manage their finances effectively and plan for the future by consolidating all their financial accounts into one platform.

Key features include:

-

- Simplified financial overview tailored for couples

- Easy account synchronization for complete tracking

- Tools to support wealth management and financial planning

- Expense analysis to help optimize spending.

With its attractive interface and simple account integration, Honeydue stands out as the top choice for those seeking effective financial tracking among other wealth management apps.

Known as a leading wealth management app, Honeydue simplifies budgeting, investment tracking, and offers personalized financial insights. Notably, it sets itself apart by being cost-effective, providing valuable features without any monthly fees.

5. Wealthfront

Wealthfront is a leading robo-advisor and wealth management app designed to simplify and automate the investment process. The app specializes in creating diversified portfolios and optimizing investments for long-term growth. After linking your accounts and setting financial goals, Wealthfront uses advanced algorithms to effectively manage and rebalance your portfolio.

Key features include:

-

- Automated portfolio management

- Goal-based investing

- Tax-efficient strategies

- Simple account linking and tracking

With its user-friendly interface and automated investment management approach, Wealthfront stands out as an ideal choice for those seeking diversified investment solutions with minimal effort. It is highly recognized as a leading robo-advisor for individuals aiming to grow their investments without the complexities of traditional wealth management. Moreover, Wealthfront offers competitive fee structures, making it an attractive option for fee-conscious investors.

6. Mezzi

Mezzi distinguishes itself as a premier AI-driven wealth management platform, going beyond basic automation to offer truly personalized financial strategies. By intelligently adapting to individual goals and evolving market conditions, Mezzi ensures investments remain consistently aligned with each user’s unique financial journey. The platform empowers users with actionable insights and tailored recommendations, fostering confident financial decision-making and optimized portfolio performance. Features like AI-powered portfolio optimization and tax-loss harvesting further enhance the user experience by minimizing risk and maximizing tax efficiency.

Key features include:

-

- Unified financial dashboard

- AI chat

- AI-powered buy & sell insights

- Tax optimization strategies

- Maintain desired diversification

- Investment tracking & performance benchmarking

Whether you’re a seasoned investor or just starting out, Mezzi’s customizable goal setting and AI-driven guidance provide the support you need to achieve your financial objectives.

How to Choose the Best Wealth Management App

Choosing the right wealth management app starts with understanding your specific needs and financial goals. Whether you’re looking for an app focused on budgeting, investment tracking, or automated investing, it’s important to carefully evaluate the features and pricing of each option before making a decision. Consider your income and requirements when deciding between a free or paid app.

While free apps may offer useful features, paid versions often provide more comprehensive tools and support to help you reach your financial goals. Be mindful of any hidden fees that may come with paid apps.

Start by using one app to familiarize yourself with its features. Once you’re comfortable, consider exploring other wealth management apps to expand your financial toolkit and enhance your strategy. Take advantage of free trials for paid apps, as they allow you to assess the app’s offerings without risk.

Ultimately, the best wealth management app is the one that aligns with your financial objectives and provides the necessary tools to achieve them. Take the time to research and compare various options to find the one that best fits your financial needs.

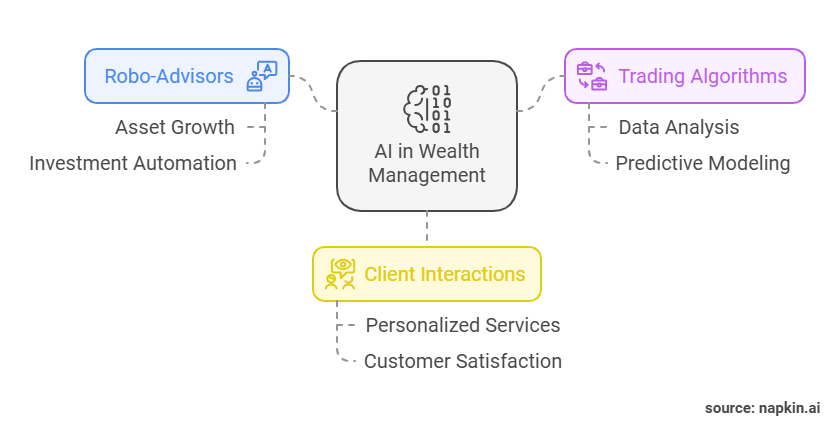

AI In Wealth Management Apps

It’s worth considering the growing influence of AI in this sector. Recent research from PwC’s 2023 Global Asset and Wealth Management Survey projects a near doubling of assets managed by automated investment platforms (often called robo-advisors), approaching a staggering $6 trillion by 2027. This dramatic growth isn’t isolated to just automated investment advice; it’s part of a larger shift. Increasingly, wealth management firms are integrating AI across their operations, from enhancing trading algorithms and uncovering insights in complex datasets to improving client interactions. This trend underscores the increasing demand for sophisticated AI solutions within the financial industry. As businesses seek to leverage the power of AI to enhance their services and remain competitive, partnering with experienced wealth management app development company is becoming crucial.

Conclusion

This top budgeting apps for 2025 provides distinct features and advantages that address different areas of financial management and investment tracking. As technology evolves, the future of wealth management apps holds even more opportunities for innovation and customization. By staying updated on the latest trends and advancements, you can maximize the potential of these tools to manage your finances and grow your wealth.

FAQs

Can I use more than one wealth management app?

Yes, you can use multiple apps to cover different aspects of your financial management.

Can I use a wealth management app without any financial experience?

Yes, many apps are designed to be user-friendly, making them accessible to users with little financial experience.

How do wealth management apps help with budgeting?

They categorize spending, monitor expenses, and help users create and stick to a budget based on income and goals.

Is it possible to use wealth management apps for family finances?

Yes, certain apps allow for shared accounts or family planning tools, making it easier to manage collective financial goals.

Let’s Build Digital Excellence Together