QuickBooks is an excellent accounting software for running SMEs and Enterprise businesses. In simple words, it’s a bookkeeping software for business owners that don’t necessarily understand accounting. QuickBooks is primarily used to automate accounting and other financial tasks that you’d have to manually before.

The reasons for choosing QuickBooks if you have a small business are easy to understand – it is extremely adaptable to most SMEs. It can not only tailor reports to individual business needs, but export reports readily to other applications.

Regardless, what makes it “the best online accounting application for small businesses” and be listed as “editor’s top picks”? – let’s find out.

Why small businesses should pick QuickBooks over alternatives

-

A Time-Saving Tool

QuickBooks is all about simplifying the accounting process. This way, you only spend a few hours a week on these tasks, rather than a few hours daily. You can even automate the daily downloads of banking and credit card transactions.

-

Management of Bills Payable and Accounts Payable

In any business, maintaining a good relationship with your suppliers and vendors is necessary. Thus, you don’t want to lag when it comes to unpaid bills to your vendors. QuickBooks allows you to track all unsettled bills and make the payments directly through online bill payment or via a check- thus, making sure that your accounts payable balance is always updated. This will not only reduce the need for unnecessary data entry but will also increase productivity.

-

Invoice Customers

When customers that want to send you money for the product/services they buy, the last thing you want to do is delay on sending them an invoice. Business owners need to know how to create and send your invoices in QuickBooks. Knowing how to properly invoice customers will reduce your accounts receivable and increase the cash flow.

-

Control Cash Flow

QuickBooks can be a great tool to assist you in managing your cash flow. Rather than using online bank balance, you can keep your QB file updated regularly and understand how to use it to manage your cash flow.

-

Instantly generate financial reports

Business owners always want to know where they stand financially at any given point. Using QuickBooks has the added benefit of creating financial reports at the click of a button. These reports will show you the sales figures, employee costs, outstanding invoices way quicker than spending hours manually creating factually correct reports.

-

Transforms your Payment system for the better

You don’t have to turn away the customers that don’t carry cash or wait for the checks in the mail. QuickBooks has the online billing option that allows you to email invoices and/or statements and has the customer pay easily via credit card.

No ERP, No Problem

Often SMEs think adopting an ERP system as a natural progression when their businesses grow and the requirements for the system used for management/administration grow in complexity and scope. On face-value moving from separate software systems to an all-in-one ERP system may seem like an obvious decision. Even so, the overall expenditure of the software implementation, staff retraining and licensing can be restricting. However, are the supplementary resources and systems ERP provides worth the cost?

Rather than utilizing an ERP that may be too-complex or over-serve the needs of your business, a more appropriate solution would be to integrate additional features into the industry-standard solution like QuickBooks.

QuickBooks is flexible, cost-justifiable- perfect for growing businesses ready for a system that integrates accounting and task modules that indirectly affect book-keeping such as payables, inventory, payroll. Meanwhile, the solution circumvents both the complexity and expenditure that may come with an ERP system.

A QuickBooks Success Story –

QuickBooks integration with company OMS saves 100000+ accounting man hours

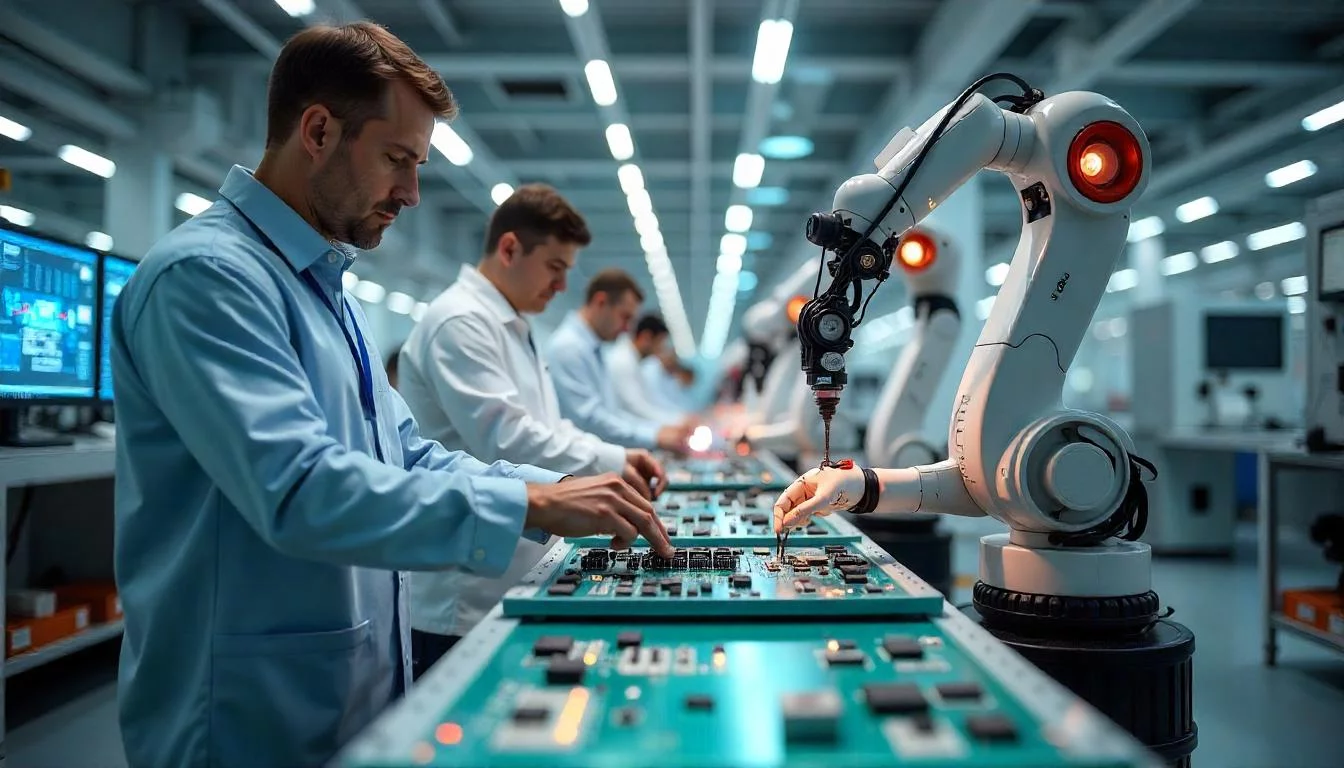

A leading hearing aid manufacturing company with more than 20,000 associated franchises were struggling with increasing efficiency in their order processing department. The company’s daily order volume would take several hours to download and enter manually into their internal system. Franchisees were spending thousands of man-hours of effort on a daily basis to create invoices, POs, Refunds, and other accounting entries. Therefore, they needed a solution that would drastically change the way they processed their orders to keep up with their new business.

Intelegain’s Solution

Intelegain integrated the company’s Order Processing System with QuickBooks accounting software allowing them to be continually automatically updated from the accounting, inventory and sales front. With inventory, order processing and financial information recording took care of as per established accounting standards, the business can now manage a significantly large number of transactions and track the data better.

Conclusion

On the whole, the company gained a robust software solution that addresses the specific needs of a growing business, providing an end-to-end solution (where an ERP solution would have been under-utilized) in a familiar setting.

Let’s Build Digital Excellence Together