The integration of finance and technology has sparked a transformative shift, revolutionizing how we manage, invest, and transact money. With the rise of fintech startups and specialized FinTech app development company, traditional financial systems are being rapidly redefined, offering unprecedented convenience, accessibility, and efficiency. The revenue of the global fintech sector is forecast to increase further in the coming years, exceeding 141.18 billion U.S. dollars in 2028.

This transformation is largely driven by the rise of Fintech app development services, which focus on developing user-friendly platforms that simplify complex financial processes, enhance security, and empower individuals and businesses to make informed financial decisions in real time.

What is a Fintech App?

A fintech app is a digital tool designed to provide financial services through mobile or web platforms. These apps can range from online banking and trading to budget management and digital payment solutions. By leveraging advanced technologies like AI/ML, blockchain, and more, fintech companies are revolutionizing online financial services, ensuring enhanced security and performance.

Fintech apps have become a preferred choice for tech-savvy users, including entrepreneurs, businesses, and banks, who seek secure, scalable, and efficient solutions to simplify their financial tasks and save time.

Choosing the Right App Type for Fintech App Development

Fintech apps come in many forms, each designed to address specific financial needs and challenges. Understanding these different types is essential for choosing the right one that aligns with your fintech app development goals. Your fintech app development company or individual fintech app developer can also provide guidance in selecting the best app type for your requirements and plans. Here’s an overview of the major types to consider.

1. Mobile Payment Digital Wallets

These applications enable users to make digital payments in-store or online using only their smartphones by storing digital copies of their debit and credit cards.

2. Payment Processing Solutions

Also referred to as payment gateways and payment apps, these tools facilitate transactions between two parties. They are commonly used by small businesses and startups that need a payment gateway and API to accept payments on their e-commerce platforms

3. Neobanks and Digital Banking Applications

These platforms provide financial products usually offered by traditional banks, like checking and savings accounts, but are accessible only via mobile or web apps. Neobank users can perform a wide range of activities, from making online payments to transferring funds and opening new accounts. Examples include Ally, Chime, Current, and Green Dot.

4. Asset and Data Management Solutions

These services enable both individual and corporate asset owners to track and manage their assets while optimizing investment portfolios. They also assist organizations in managing financial data, ensuring legal compliance, and simplifying financial reporting.

5. Alternative Credit Scoring Solutions

These services go beyond traditional credit scoring models and evaluate a customer’s creditworthiness using alternative data sources. This includes information on an individual’s payment history for services like utilities, telecoms, and rental contracts.

6. Buy Now, Pay Later (BNPL) Services

These providers enable customers to break their purchases into smaller, interest-free payments over a set period.

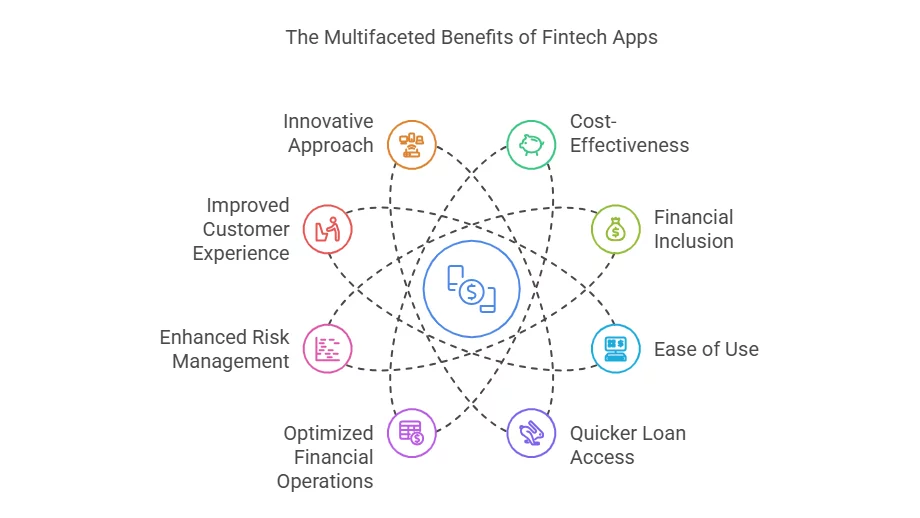

Benefits of Fintech Apps

As the demand for innovative financial solutions grows, companies are seeking expert FinTech app development services to build FinTech apps that cater to the evolving needs of consumers. From enhancing efficiency to providing better customer experiences, these applications offer numerous benefits that go beyond traditional financial services. Below are some of the key benefits of using fintech apps.

1. Cost-Effectiveness

One key benefit of fintech app development is cost reduction, as finance mobile app development services enable code reusability across platforms, leading to savings in both time and money. This allows developers to focus on other crucial aspects of application development. Automation of several operations, particularly in areas like credit risk, reduces the need for human intervention, lowering client service costs.

2. Financial Inclusion and Deepening

Fintech apps play a significant role in promoting financial inclusion and deepening by enhancing the consumer experience with superior financial services. They improve customers’ access to banking, support savings, and offer greater convenience and satisfaction.

3. Ease of Use

Fintech apps are designed for convenience, boosting efficiency and simplifying transactions through mobile connectivity. This results in a better user experience, greater access to information, and improved business transparency. Additionally, fintech has extended financial products to unbanked individuals, ensuring financial services are available to everyone in need.

4. Quicker Loan Access

Fintech enables fast, same-day loan approvals for both personal and business needs through various online lenders. These services are efficient and customizable, allowing fintech apps to simplify complex business tasks and assist startups in raising funds with a variety of funding options.

5. Optimized Financial Operations

Finance is a crucial but often mismanaged area of business. Fintech excels in streamlining financial processes by enabling businesses to manage their books more effectively. Digital banking platforms automate vital financial operations, allowing businesses to view transactions in real time, receive instant updates, and process payments quickly. Controlled access features in digital banks further ensure account security with assigned privileges.

6. Enhanced Risk Management

Fintech helps businesses manage risks by offering advanced analytics capabilities. Through automation, machine learning, and big data, fintech apps analyze vast amounts of data and deliver insights in seconds, aiding decision-making. They also assist in combating illegal activities like money laundering by monitoring transactions in real time. Additionally, fintech helps mitigate risks, improving customer experiences with features like buy-now, pay-later options.

7. Improved Customer Experience

Fintech products streamline investment processes, enhancing organizational efficiency and growth. The adoption of fintech at a low cost can significantly boost customer satisfaction. Faster service and increased convenience lead to higher customer retention, while technologies like Big Data and AI offer personalized experiences based on customers’ past interactions and financial status.

8. Innovative Approach

Fintech apps have transformed industries with their innovative use of technology. With the ease of use of e-wallet applications, customers are drawn to these platforms. By incorporating advanced technologies such as AI, AR, and IoT, fintech continues to elevate customer experiences and drive businesses forward.

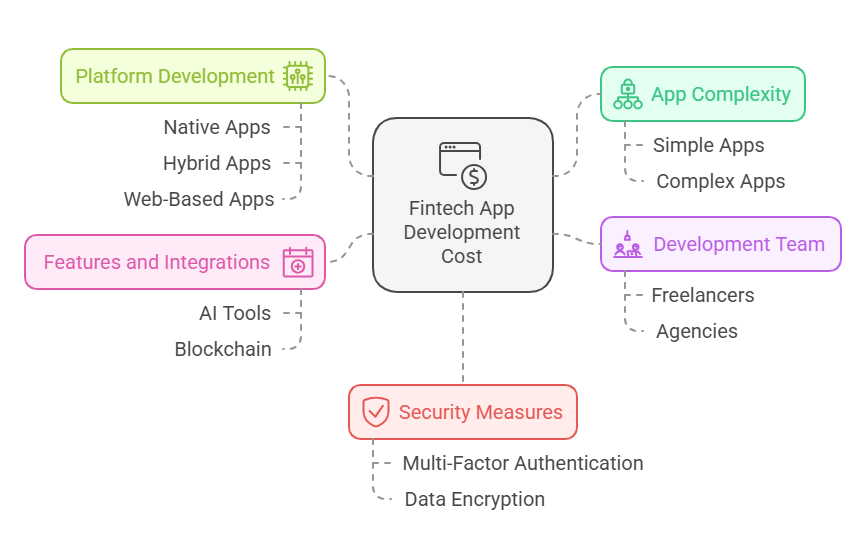

Deciding Factors of Fintech App Development Cost

The cost of Fintech app development can differ greatly based on various crucial factors like the fintech app development company, which fintech app development services, fintech app type you are choosing and many more. Below is a detailed overview of how these elements impact the total development budget:

1. App Complexity

The development cost is influenced by the app’s complexity. Simple apps with minimal functionalities are more affordable to create than feature-rich applications. For instance, a basic budgeting app with simple tracking tools will cost less to develop than an advanced investment app that includes stock trading and portfolio management capabilities.

2. Development Team

The budget for your development team largely depends on their location and level of experience. Employing freelancers or app development agencies from regions with lower rates can reduce costs. However, this approach may involve potential drawbacks in terms of skills, communication, and streamlined workflows. Conversely, seasoned developers with a strong background in Fintech app development often come with a higher price tag but offer a more efficient development process and superior product quality.

3. Platform Development

The choice of platform for your app significantly affects the overall development cost.

-

- Native Apps (iOS or Android): Native apps deliver top-tier performance and user experience but require separate development for each platform, which can substantially increase costs.

- Hybrid Apps: Built using a single codebase, hybrid apps work on both iOS and Android devices, making them a more cost-effective choice. However, they may not provide the same seamless experience as native apps.

- Web-Based Apps: Accessible via any web browser, web apps eliminate the need for platform-specific development. However, their functionality may be more limited compared to native counterparts.

4. Features and Integrations

The cost of developing your Fintech app is heavily influenced by the features and third-party integrations you decide to incorporate. Advanced functionalities, such as AI-driven budgeting tools or blockchain capabilities, can increase both the development effort and overall cost.

5. Security Measures

Ensuring strong security is crucial for Fintech apps that manage sensitive financial data. Implementing features such as multi-factor authentication, data encryption, and secure coding practices may increase development costs, but they are vital for gaining user trust and safeguarding information.

Estimates Fintech App Development Cost

On average, the cost to develop a fintech app can range anywhere from $50,000 to $200,000, particularly as the app scales and incorporates more advanced features over time. However, if you’re looking to develop a Minimum Viable Product (MVP) to test the waters with basic features and functionalities, the cost can be significantly lower, typically between $15,000 and $20,000. Keep in mind, these estimates serve as general guidelines, and the actual development cost will depend on your specific requirements and the development approach you choose.

It’s important to plan your budget carefully by considering not only the initial development but also the ongoing costs related to maintenance, updates, security, and potential new features throughout the app’s lifecycle. Take into account ongoing maintenance, bug fixes, security updates, and the integration of potential new features as additional expenses to be considered during your app’s lifecycle.

By thoroughly evaluating these cost factors and clearly defining your app’s functionalities from the start, you can establish a practical budget for your Fintech app development project.

Why Intelegain is the Ideal Fintech App Development Company?

As we conclude this article, we trust that you now have a deeper understanding of the process involved in developing a fintech app and how it can define the scope of your project. Fintech apps offer immense value not only to consumers but also enable finance businesses to streamline their financial operations effectively.

Intelegain, a leading fintech app development company, has significant experience in creating a wide range of fintech applications. We are passionate about innovation and have successfully assisted numerous clients worldwide in developing cutting-edge fintech solutions that have driven their business transformation and helped them achieve a dominant position in the market. Contact us today for free consultation.

FAQs

1. How Long Does It Usually Take to Develop a Fintech App?

The timeline for developing a fintech app can vary based on factors like the app’s complexity, desired features, design needs, and the expertise and size of the development team. Generally, creating a minimum viable product (MVP) can take around three months, while a fully developed fintech app may take anywhere from 5 to 8 months or longer.

2. Can I Start with a Basic Version (MVP) and Add Features Later to Reduce the Initial Cost?

Yes, you can start with a basic version of your Fintech app by using the Minimum Viable Product (MVP) strategy and then add features over time. This approach enables you to launch the app with essential functionalities, gather feedback from users, and prioritize additional features based on user demands and available budget.

3. Are there recurring expenses involved in maintaining a fintech app?

Yes, maintaining a Fintech app involves recurring expenses. These include hosting and server maintenance costs, periodic updates to ensure compatibility with new operating systems, bug fixes, security upgrades, and customer support. It’s essential to consider these costs when planning for the app’s long-term viability

4. Can fintech app development services include cross-platform development?

Yes, fintech app development services often offer cross-platform development using frameworks like React Native or Flutter to create apps that work seamlessly across iOS and Android platforms, saving time and cost.